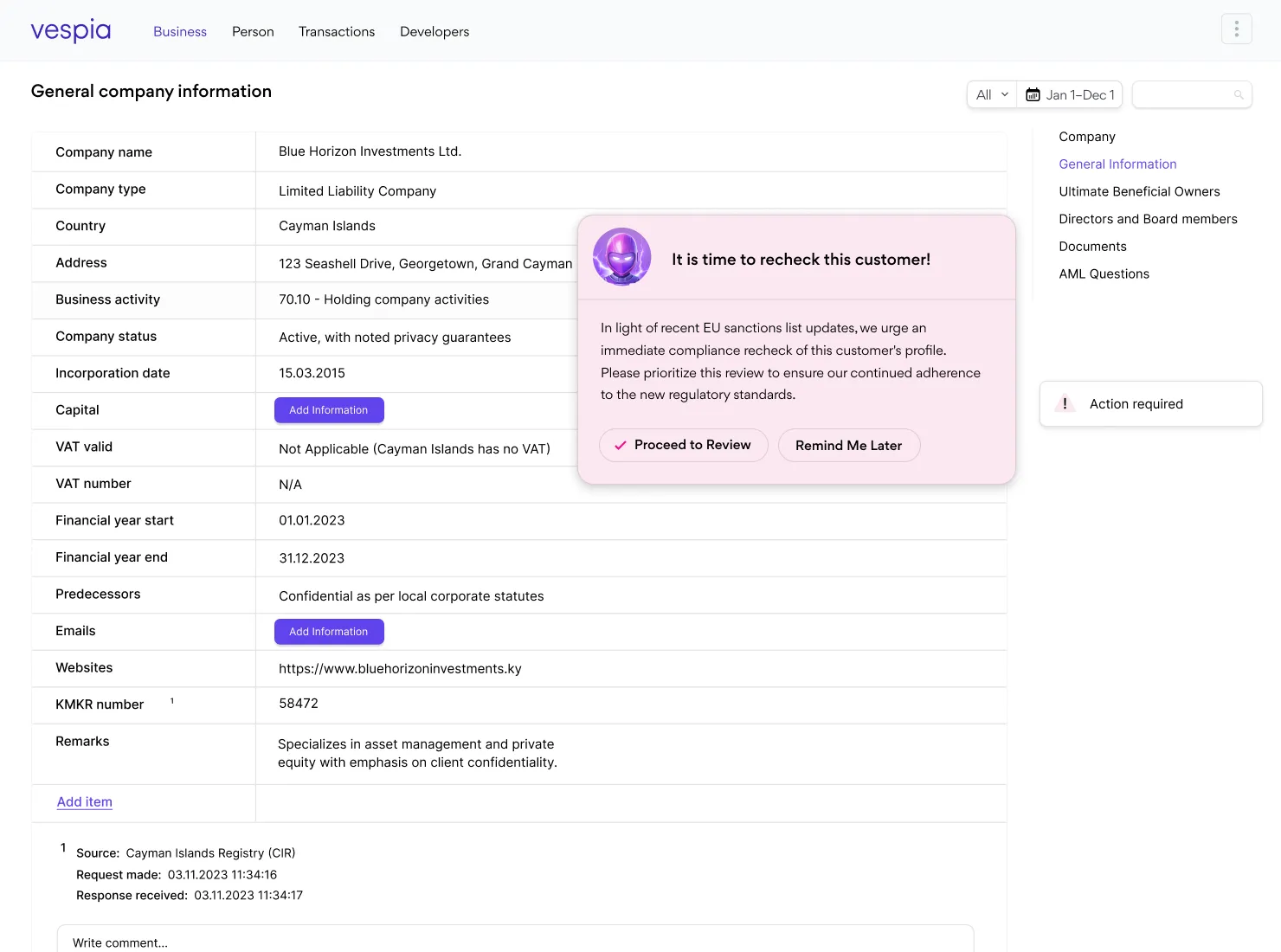

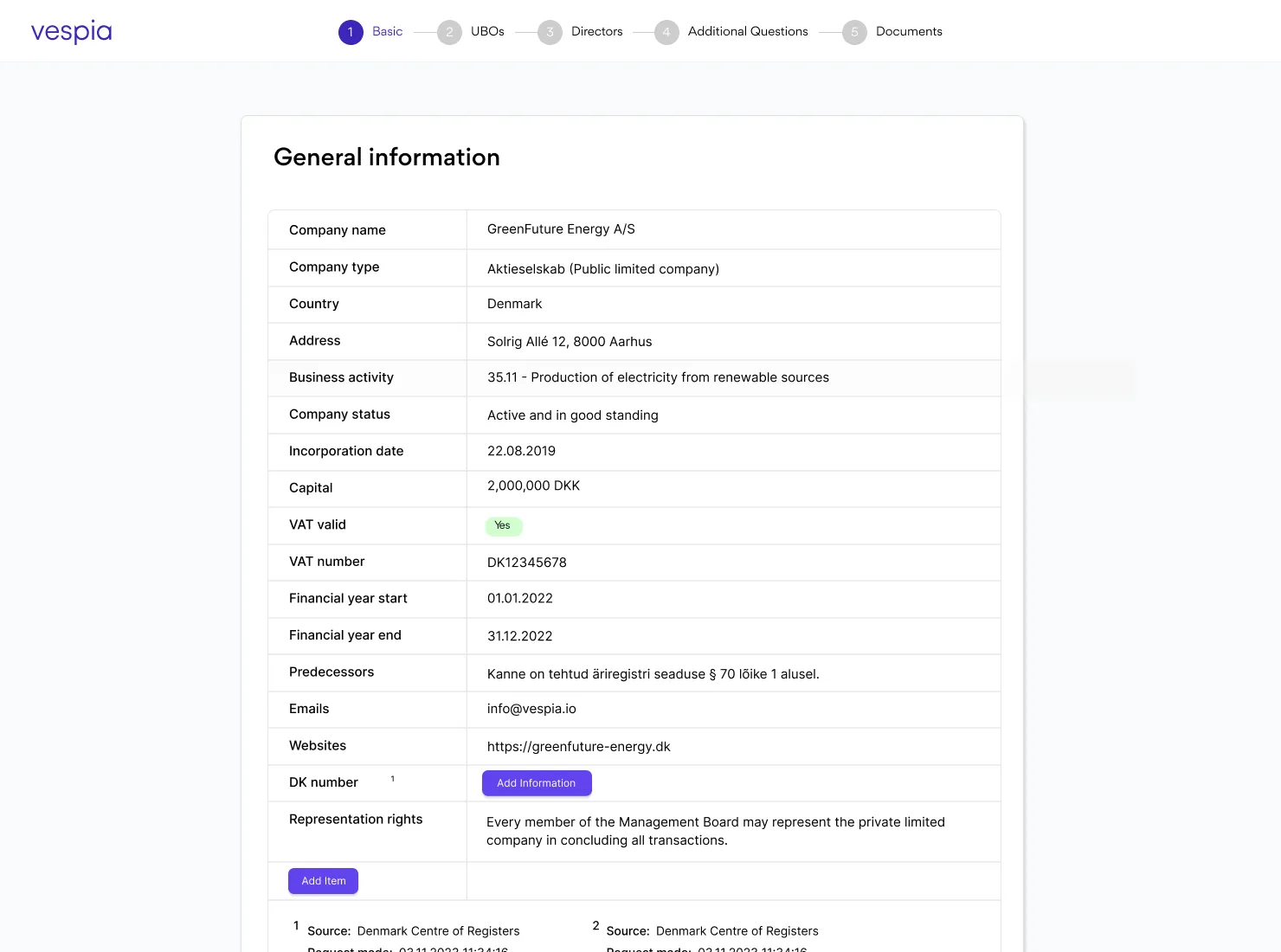

Vespia has made it easy to find out who you’re dealing with, no matter where they are established in the world. All the information you need to know is just a few clicks away.

| Rule 4 | 20.21.2023 |  |

| Rule 36 | 20.21.2023 |  |

| Rule 68 | 20.21.2023 |  |

| Rule 12 | 20.21.2023 |  |

Vespia has made it easy to find out who you’re dealing with, no matter where they are established in the world. All the information you need to know is just a few clicks away.

Vespia is bringing KYB and KYC into the modern world. With their help, we make sure that our compliance team fills in the data gap in a user-friendly way to simplify the process of staying AML compliant and please the regulators.

Our experience with Vespia has been extraordinarily positive. Apart from their technological excellence and commitment to compliance, what truly sets them apart is the unparalleled support from their technical team.

1// RequestKybVerificationInput mutation

2

3mutation Mutation($input: RequestKybVerificationInput!) {

4 requestKybVerification(input: $input) {

5 id

6 }

7}

8

9{

10 "input": {

11 "name": "company_name",

12 "registrationCode": "registration_code",

13 "countryCode": "country_code"

14 }

151Authorization: Bearer $tokenTransaction monitoring refers to the continuous oversight of customer transactions to identify unusual patterns or behaviours. It's a crucial component of anti-money laundering (AML) and counter-terrorist financing (CTF) programs. By monitoring transactions, financial institutions can detect potentially suspicious activities, investigate them further, and report them to relevant authorities if necessary.

AI Transaction Monitoring uses artificial intelligence to analyze transaction patterns, identify anomalies, and provide real-time alerts for potentially suspicious activities.

While AI adapts and learns from transaction patterns, rule-based monitoring ensures that specific regulatory and business-specific criteria are always met, offering a dual-layered approach to transaction oversight.

Mitigate risks confidently – Empower your business with Vespia's reliable and dynamic risk assessment solution!

By continuously learning from transaction data and refining its criteria, AI can more accurately distinguish between genuine anomalies and regular business activities, significantly reducing false alerts.

Starting with Vespia Tx is easy. Simply sign up, choose the package that fits your needs, and start Transaction Monitoring today! If you have special requirements or need to handle large volumes, our sales team is ready to create a custom approach tailored to your business. Contact us to discuss your unique needs.